Our electrical infrastructure is being strained at an unprecedented rate. Those producing electricity to the grid are being pressured to provide increased capacity to satisfy the ever-increasing demand. The market trends which are pushing this capacity requirement higher and higher are mainly required by the following:

- Increased electrification driven by decarbonization efforts

- The rapid expansion of AI and data centers to fuel its growth

- Increased domestic manufacturing

- Retirement of older fossil fuel power plants

- Continual need to invest in new electricity transmission and distribution infrastructure

Understanding Your Bill

Your monthly electricity bill is comprised of several components, many of which are nominal and fixed: including customer charges, regulatory riders, and electricity delivery costs (transmission and distribution.)

The two components which can be most directly influenced are:

- Demand – (which includes Capacity Market or ‘auction’ costs) which is established by your Peak Load Contribution (PLC). Regional Grid Operators (such as PJM) determine your contribution by measuring your power demand, during a 15 minute to 1 hour interval during the five highest peak demand hours across the entire PJM region during the year.

- Your energy (kWh) usage during a month – which is determined by measuring hourly electricity usage and billing accordingly at a predetermined rate which is the lesser of either a) the investor-owned and publicly regulated utility costs via a published rider cost, or b) through a Competitive Retail Electricity Supplier (CRES.)

Due to last year’s capacity auction results in several major Regional Grid Markets (PJM, MISO etc.), we want to share some insights as to the steps you can take to minimize the impact of the new demand charges forthcoming imminently, as these costs will have the largest proportional increase on your electric bill beginning June 2025. This increase is expected to last for a minimum of a year and likely be longer, due to the grid requiring more generation capacity, which will require a multi-year market signal and time to build.

What does this mean for your organization?

Understanding the Problem

Until recently, non-energy usage charges have been a smaller portion of your electric bill; now demand costs are likely to contribute materially to your overall cost structure. We anticipate they’ll be an important expense to manage against and proactively address. The challenge is that high usage of electricity for short periods of time can set your PLC contribution and ‘lock in’ high costs tied to your monthly billing capacity charges throughout the entire year. This is how utilities fund the infrastructure needed to meet peak demand across all customers. By understanding this mechanism, we can develop strategies to flatten your energy usage profile and minimize financial risks.

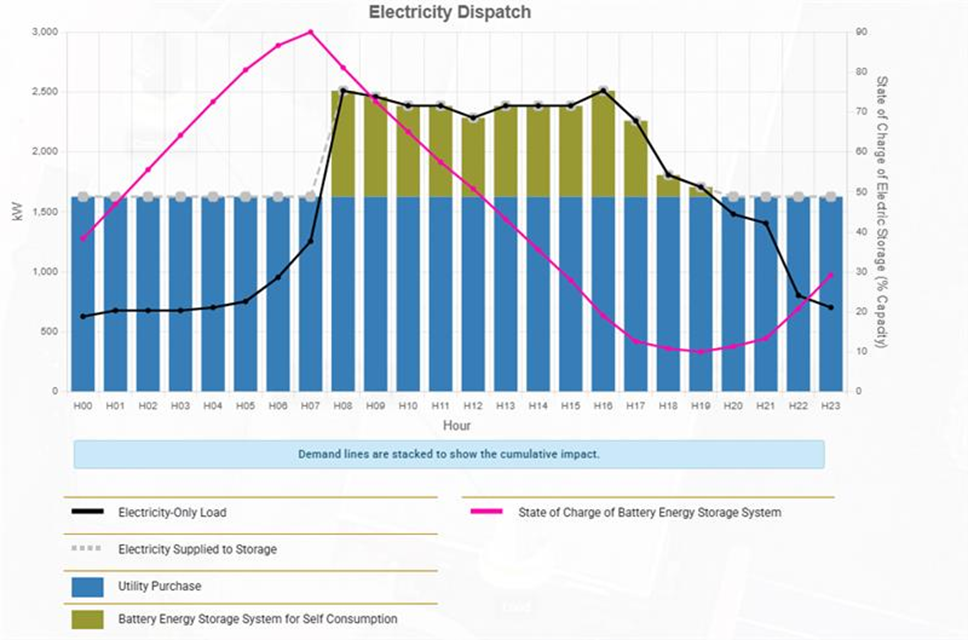

Our goal is to help you flatten out your profile by reducing the magnitude of your Peak Load Contribution. Below is an example which shows the use of a battery storage system to flatten out a load profile and minimize the peak demand seen at the meter. Flattening a power usage profile will lower the demand charge when operating in this fashion throughout the year, resulting in lower electricity bills. This graph shows utilizing a battery system which recharges during a low demand period for the facility and discharges during peak usage.

If the facility operates without battery storage, the peak demand for the day would be 2500 kW. When operated with battery storage, the peak demand lowers to 1600 kW, effectively decreasing the demand charge by 36%, and resulting in a direct reduction to the demand charge portion of the monthly bill. This is one example of a constructed solution to

address the issue, but you can also utilize an operational approach.

Constructed Solution Opportunities

Constructed solutions require financial investment to implement; They can be either self-financed, or obtained at no initial capital cost through providers of Energy-As-A-Service. Direct ownership provides more control, but carries additional risk while third party involvement may reduce risk, but require shared savings and benefits. Direct ownership may also require compelling payback and ROI, whereas third party partnerships likely provide immediate savings and benefits (if slightly more marginal), as you are no longer risking scarce capital.

Reduced demand charges, added resiliency during grid outage events, and increased operational flexibility, are great co-benefits. For instance, the implementation of battery storage in conjunction with a renewable energy source, or fossil fuel source, can be leveraged to provide continuous power to the facility in a grid outage occurrence as well as utilized to peak shave.

As an owner, you should be aware that renewable energy sources alone or the implementation of a peak shaving scheme which does not have redundancy will not provide you with the means to protect your organization against a peak demand event.

As an example, solar, without battery, will provide peak shaving during a certain window during the day but will not assist in morning warm up/cool down or in the event of an overcast day. Another method of peak shaving is to use a single micro turbine, but if it goes offline or maintenance is not scheduled for off-peak times, even a few hours of unavailability could negate any peak shaving benefits. There are many factors (facility type, hours of operation, natural gas availability and pricing in your area, etc.) which must be considered, and a system must be tailored to your organizational use case.

Operational Approach Opportunities

Operational opportunities can sometimes be achieved by simple practice changes within your organization such as shifting some energy use to non-peak times, or modifications to non-load critical areas of the building to result in less heat, cooling, or process load usage during peak events.

Also, other utility-driven programs such as Demand Response may already be available that could benefit your organization. These programs can be leveraged to reduce your demand or utilize your existing standby equipment to assist the utility during peak grid events. Demand reduction strategies should be placed in service this Summer (2025) to mitigate projected costs of future capacity auctions.

Final Thoughts

Working with the correct trusted partner to tailor your power strategy is critical to flatlining your load. This will minimize your demand charges and minimize the impact of your facility on the local and regional grid so that it can better serve you, your local colleagues, and your community. Reducing peak demand reduces stress on local power systems, improving reliability across the network.

Diligent facility management is critical to prevent peak events that could lock in high demand charges for months. This means carefully monitoring your system and equipment usage – for example, not staging all your chillers for a once-a-year test in the middle of the day, as this would create an unnecessary peak. If a peak is created, the power company will charge based on that peak for the entire year, and there is typically no way to modify that peak charge until the year duration is complete.

You can trust HEAPY’s depth of expertise to:

- Properly study your system and develop plans of action (both low costs and capital projects) for consideration

- Design recommended solutions

- Provide pricing and procurement strategies

- Develop and provide a turnkey solution on constructed approaches

- Aid work with utilities on existing programs

- Provide custom financial engineering partnerships and solutions to help you get your projects executed

We want our clients to be aware of these upcoming changes and have a chance to get this into their budgets for the upcoming year, as these rate changes are imminent. Contact us to secure your organization’s success through this upcoming change.