Adopting more sustainable building practices and reducing carbon emissions is a multifaceted challenge for many organizations.

Adopting more sustainable building practices and reducing carbon emissions is a multifaceted challenge for many organizations.

While the benefits — such as energy savings, reduced environmental impact, and improved brand reputation — are clear, the complexity of implementing these initiatives can be daunting. The process involves careful planning, strategic decision-making, and navigating a variety of financial, technical, and operational considerations.

In this expert Q&A, Jamie Feltes, HEAPY’s Project Finance Strategy Leader, shares insights on how educational institutions can strategically approach and manage these challenges to make informed investment decisions.

Q: Organizations often face challenges in determining where to begin their sustainability efforts. What’s a good starting point for organizations just beginning their sustainability journey?

Answer: Assessment of the impact of Energy Efficiency Measures (EEMs) on building performance. This evaluation helps identify solutions that can be implemented progressively. They maximize both financial benefits and building health. By adopting EEMs, educational institutions can achieve early wins. They can reduce operational costs, improve energy efficiency, and enhance air quality to ensure better health and safety for students, faculty, and staff.

The implementation of these measures also contributes to creating safer, healthier learning and working environments, supporting both the institution’s sustainability goals and the well-being of its community.

Q: What key considerations should organizations take into account to make more informed long-term capital investment decisions, particularly when upgrading existing infrastructure or constructing new facilities?

Answer: Renewable energy and energy-efficient infrastructure often require a significant upfront investment. The long-term savings in energy and operational costs make these investments highly valuable for educational institutions. Effective planning is crucial. Rather than simply replacing existing systems on a 1-for-1 basis, schools and universities should explore opportunities. Such opportunities include energy efficient building systems, solar, or geothermal. These optimize future operating costs while addressing upcoming lifecycle needs.

Answer: Renewable energy and energy-efficient infrastructure often require a significant upfront investment. The long-term savings in energy and operational costs make these investments highly valuable for educational institutions. Effective planning is crucial. Rather than simply replacing existing systems on a 1-for-1 basis, schools and universities should explore opportunities. Such opportunities include energy efficient building systems, solar, or geothermal. These optimize future operating costs while addressing upcoming lifecycle needs.

Innovative energy solutions, such as data-driven optimization, can allow for phased implementation, enabling institutions to manage resources more effectively. Additionally, prioritizing emissions reduction is essential, as it not only provides tangible benefits but also drives organizational transformation and supports long-term sustainability goals.

Q: How are the expectations of society and stakeholders changing and putting increased pressure on organizations to adopt and implement sustainability and carbon reduction measures?

Answer: Educational institutions must be mindful of the future financial risks associated with sustainability expectations, regulatory requirements, and evolving design standards. The pressure to adopt and implement sustainability and carbon reduction measures is increasing from multiple sources — including society, students, faculty, government regulators, and the broader community.

Institutions that fail to meet these growing expectations risk not only regulatory penalties, but also the potential loss of reputation, student enrollment, and faculty talent. On the other hand, those that embrace sustainability are better positioned to thrive in the long term, benefiting from an enhanced reputation, stronger community loyalty, and a more resilient operational model.

Sustainability is no longer a “nice-to-have” but a core imperative for educational institutions, directly influencing their long-term success. Today, sustainability risks are seen as financial risks, but they also present valuable opportunities for financial and institutional growth.

Q: In the past few years, the market has shifted dramatically, with more funding available than ever before. Why is now the time to get started with decarbonization?

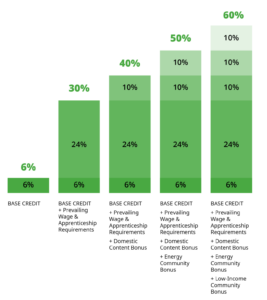

Answer: With increased utility costs at our doorstep, the cost of delaying action can be substantial. The current funding environment is unprecedented, thanks in large part to the Inflation Reduction Act (IRA). This act has expanded and modified tax credits and deductions, introduced new energy credits, provided bonuses for domestic content and low-income community projects, and allowed for direct pay and transferability elections. Non-tax grants are also available, making it an opportune moment for organizations to act. However, tax benefits don’t last forever.

Answer: With increased utility costs at our doorstep, the cost of delaying action can be substantial. The current funding environment is unprecedented, thanks in large part to the Inflation Reduction Act (IRA). This act has expanded and modified tax credits and deductions, introduced new energy credits, provided bonuses for domestic content and low-income community projects, and allowed for direct pay and transferability elections. Non-tax grants are also available, making it an opportune moment for organizations to act. However, tax benefits don’t last forever.

Many of these incentives are set to phase out or decrease in value over time, and delaying action could significantly impact ROI. By waiting, organizations risk losing the full potential of these incentives. You can ultimately lower the financial returns on energy property investments and diminish the overall value of future savings.

Q: What attributes make financiers best in class when considering your built environment project?

Answer: A major barrier to sustainability projects in the education sector is the high upfront capital required. While these projects offer long-term savings and positive ROI, the initial investment can be a challenge. Innovative financial partners can help bridge this gap, enabling educational institutions to pursue sustainability initiatives without the heavy burden of immediate costs.

Top-tier financiers bring deep expertise in energy assets, flexible financing options, and a strong understanding of an institution’s specific needs and financial model. They offer technical support to validate and verify projects and have their own sustainability strategies. Additionally, they can integrate available rebates, tax credits, and incentives into the funding structure, providing scalable solutions for a variety of project types.

With the right financial partners, educational institutions can move forward with minimal upfront payments. You can take advantage of current incentives and creative funding solutions designed for clean energy technologies. Available financing options include loans, leases, project financing (e.g., PPAs and Energy Service Agreements), tax-exempt credit facilities, bridge loans, construction draw facilities, Greenbank solutions, and C-PACE.

Q: What are some special considerations for educational institutions looking to invest in renewable energy or decarbonization?

Answer: When educational institutions pursue renewable energy or decarbonization projects, they must consider several critical factors. Financial constraints are a key concern. The current funding landscape—especially with the Inflation Reduction Act (IRA)—provides significant tax credits, grants, and other incentives to help offset initial costs.

To minimize upfront investment, schools should explore financing options like Power Purchase Agreements (PPAs) or Energy-as-a-Service (EaaS) models. Institutions must also carefully plan for long-term return on investment (ROI), as many incentives will likely phase out.

They should also prioritize campus-wide electrical upgrades to support new technologies in retrofitted buildings. You can integrate renewable energy systems (e.g., solar, geothermal) with smart building technologies. These boost energy efficiency and resilience. Additionally, institutions must ensure ongoing maintenance and monitoring systems are in place to sustain energy performance and avoid costly repairs over time.

They should also prioritize campus-wide electrical upgrades to support new technologies in retrofitted buildings. You can integrate renewable energy systems (e.g., solar, geothermal) with smart building technologies. These boost energy efficiency and resilience. Additionally, institutions must ensure ongoing maintenance and monitoring systems are in place to sustain energy performance and avoid costly repairs over time.

Lastly, stakeholder engagement—including faculty, students, and the local community—is crucial to building support for these initiatives.

Now is the ideal moment to plan for the future, as the coming decades are expected to bring volatility in energy costs, equipment availability, and evolving regulations on emissions and fossil fuels. Proactive planning allows institutions with large real estate portfolios to secure significant long-term advantages.

While transitioning to sustainable practices can be complex, the right strategies and financial support can make it both feasible and rewarding in the long run.

As Jamie emphasizes, adopting a phased approach, capitalizing on available funding opportunities, and partnering with experienced financial experts can position organizations for success. For more information or to discuss your project’s financial strategy, contact her at jafeltes@heapy.com.